library(tidyverse)

library(survival)고객 이탈 예측을 위한 생존분석

탐구 동기 및 목표

- 강의 시간에는 의학 분야 예제로 생존분석을 공부했는데, 기존에 관심있던 마케팅 분야에서 생존분석이 어떻게 활용될 수 있는지 탐구하고자 함.

- 고객 데이터의 생존함수와 위험함수로부터 데이터에 대한 이해를 넓히고자 하며, 이후 Cox 비례 위험 모형을 적합한 후 모형의 예측 정도를 확인하고자 함.

data("churnTel", package = "liver")데이터 설명

liver 패키지의 churnTel 데이터에는 7,043개의 관측치에 대한 21개 변수가 존재함(Mohammadi and Burke 2023).

| 변수 | 설명 |

|---|---|

| customer.ID | Customer ID. |

| gender | Whether the customer is a male or a female. |

| senior.citizen | Whether the customer is a senior citizen or not (1, 0). |

| partner | Whether the customer has a partner or not (yes, no). |

| dependent | Whether the customer has dependents or not (yes, no). |

| tenure | Number of months the customer has stayed with the company. |

| phone.service | Whether the customer has a phone service or not (yes, no). |

| multiple.lines | Whether the customer has multiple lines or not (yes, no, no phone service). |

| internet.service | Customer’s internet service provider (DSL, fiber optic, no). |

| online.security | Whether the customer has online security or not (yes, no, no internet service). |

| online.backup | Whether the customer has online backup or not (yes, no, no internet service). |

| device.protection | Whether the customer has device protection or not (yes, no, no internet service). |

| tech.support | Whether the customer has tech support or not (yes, no, no internet service). |

| streaming.TV | Whether the customer has streaming TV or not (yes, no, no internet service). |

| streaming.movie | Whether the customer has streaming movies or not (yes, no, no internet service). |

| contract | The contract term of the customer (month to month, 1 year, 2 year). |

| paperless.bill | Whether the customer has paperless billing or not (yes, no). |

| payment.method | The customer’s payment method (electronic check, mail check, bank transfer, credit card). |

| monthly.charge | The amount charged to the customer monthly. |

| total.charges | The total amount charged to the customer. |

| churn | Whether the customer churned or not (yes or no). |

문제에서 관심있는 event인 churn은 고객에 대해서 한 번만 발생하는 event로, 그 값은 yes 또는 no 임.

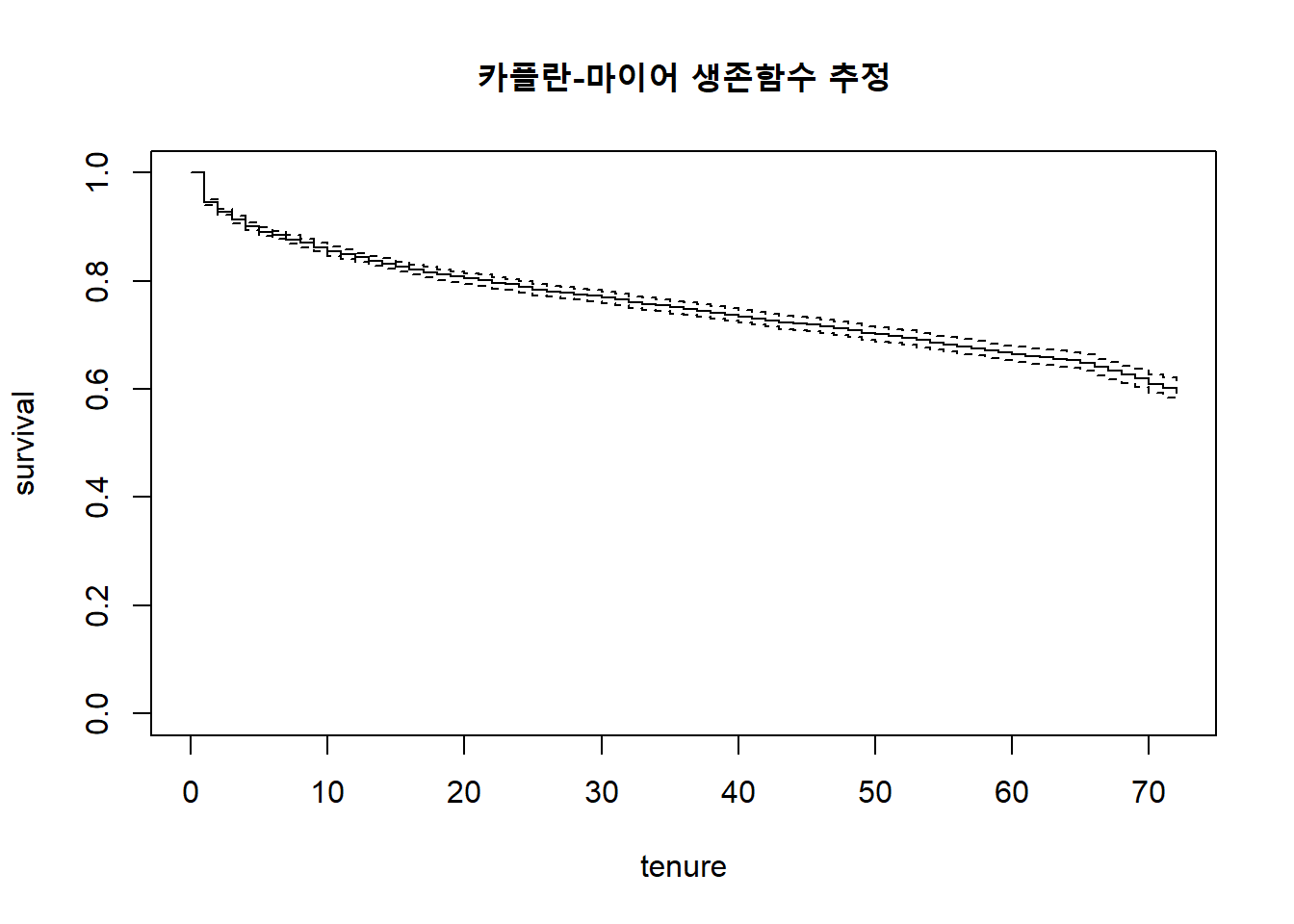

비모수적 생존함수 추정 (카플란-마이어 방법)

데이터로부터 생존곡선을 산출하는 Kaplan-Meier 방법을 적용함.

만약 관측치가 censored 된 경우는 0, 그렇지 않으면 1로 status indicator를 정의함. 예제에서 censored 되는 경우는 실험이 종료될 때까지 event가 발생하지 않은 경우로, 다른 censoring의 경우인 loss to follow-up은 해당 데이터에서 발생하지 않음.

time <- churnTel$tenure

status <- ifelse(churnTel$churn == "yes", 1, 0)

surv.fit <- survfit(Surv(time, status) ~ 1)

plot(surv.fit, main="카플란-마이어 생존함수 추정",

xlab="tenure", ylab="survival")

output <- tibble(time=surv.fit$time,

surv=surv.fit$surv) %>%

mutate(space=time*surv) %>%

summarise(avg_life_time=mean(space)) %>%

pull()

print(output)[1] 25.68115생존함수에서 구한 평균이 실제 구독 기간의 평균을 의미하는 것은 아님. 하지만 해당 추정치는 고객 유지 예산 예산 배정의 문제에 도움을 줄 수 있음(Linoff and Berry 2011).

surv.fit <- survfit(Surv(time, status) ~ internet.service,

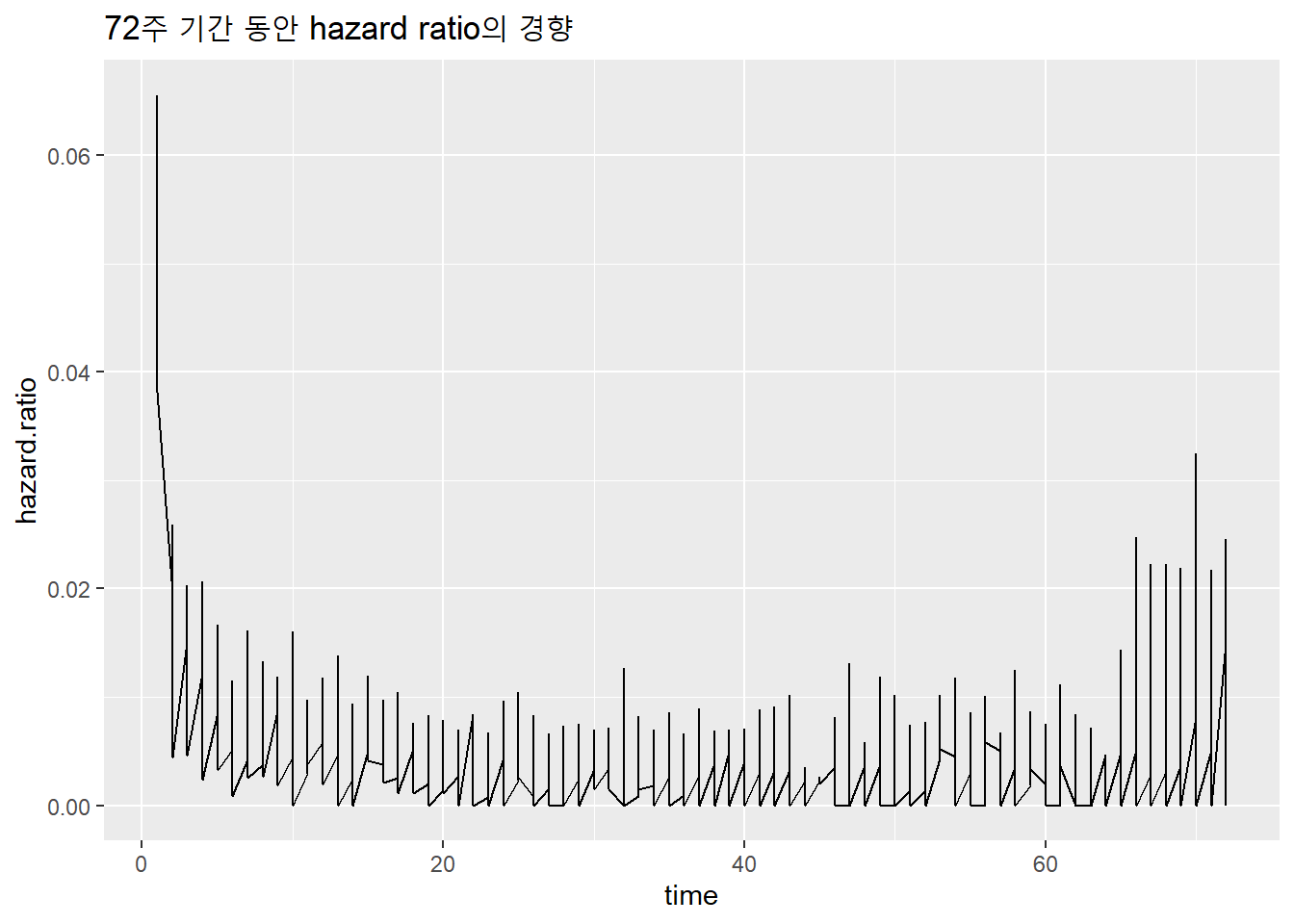

data=churnTel)Hazard의 경향 확인

time

Kaplan-Meier 적합 시 생성되는 table을 활용하여 데이터로부터 경험적 Hazard ratio를 구할 수 있음.

구독 모델의 경우 초기 진입 이후 프로모션이 끝나면 이탈하는 고객이 있음으로 시간에 따른 Hazard의 모양은 U-자형으로 보임.

tibble(time=surv.fit$time,

n.event=surv.fit$n.event,

n.risk=surv.fit$n.risk) %>%

mutate(hazard.ratio=n.event/n.risk) %>%

ggplot() +

geom_line(aes(x=time, y=hazard.ratio)) +

ggtitle("72주 기간 동안 hazard ratio의 경향")

Cox 비례 위험 모형

idx <- churnTel %>%

mutate(idx = row_number()) %>%

filter(internet.service != "no") %>%

filter(phone.service != "no") %>%

pull(idx)data <- churnTel[idx, ] %>%

mutate(across(where(is.factor), droplevels)) %>%

select(-c(customer.ID, phone.service, total.charge))N <- nrow(data) * 0.2

test <- sample(nrow(data), N)

train <- setdiff(1:nrow(data), test)coxph.churn <-

coxph(Surv(tenure, churn=="yes") ~ .,

data=data,

subset=train)비례위험모형

Cox 비례 위험 모형을 구축함. phone, internet service를 모두 구독하는 고객에 대해서만 Cox 모델 적합을 수행함. (no phone or internet service 고객에 대해서도 모형 적합 시 일부 계수값이 정해지지 않음)

coefficients(summary(coxph.churn)) coef exp(coef) se(coef) z

gendermale -0.14000649 0.86935259 0.05668604 -2.46985833

senior.citizen -0.06279092 0.93913981 0.06713907 -0.93523658

partnerno 0.56322692 1.75633091 0.06705128 8.39994266

dependentno -0.04698411 0.95410256 0.08255439 -0.56912917

multiple.linesno 0.57683107 1.78038756 0.14661067 3.93444135

internet.servicefiber-optic -0.04586767 0.95516835 0.66911320 -0.06854994

online.securityno 0.78080968 2.18323928 0.15684596 4.97819434

online.backupno 0.76636692 2.15193389 0.14736252 5.20055535

device.protectionno 0.41632388 1.51637692 0.14670234 2.83788173

tech.supportno 0.49446794 1.63962563 0.15606867 3.16827162

streaming.TVno 0.13869006 1.14876799 0.27639848 0.50177576

streaming.movieno 0.37370181 1.45310378 0.27419150 1.36292267

contract1-year -1.45230251 0.23403081 0.10806781 -13.43880738

contract2-year -2.81371129 0.05998197 0.20275502 -13.87739423

paperless.billno -0.18590050 0.83035621 0.06951982 -2.67406465

payment.methodcredit-card -0.05676702 0.94481417 0.10967605 -0.51758812

payment.methodelectronic-check 0.58746196 1.79941563 0.08558140 6.86436502

payment.methodmail-check 0.46141960 1.58632434 0.11183417 4.12592685

monthly.charge 0.01759745 1.01775320 0.02667217 0.65976814

Pr(>|z|)

gendermale 1.351666e-02

senior.citizen 3.496664e-01

partnerno 4.466967e-17

dependentno 5.692685e-01

multiple.linesno 8.339043e-05

internet.servicefiber-optic 9.453479e-01

online.securityno 6.418020e-07

online.backupno 1.986939e-07

device.protectionno 4.541401e-03

tech.supportno 1.533482e-03

streaming.TVno 6.158253e-01

streaming.movieno 1.729069e-01

contract1-year 3.581625e-41

contract2-year 8.684410e-44

paperless.billno 7.493800e-03

payment.methodcredit-card 6.047457e-01

payment.methodelectronic-check 6.678766e-12

payment.methodmail-check 3.692446e-05

monthly.charge 5.094026e-01모형의 평가

모형의 평가지표로 Concordance index(c-index)를 사용할 수 있음. 이는 모든 개체 짝 중 이벤트의 발생이 먼저 일어난 개체가 상대적 위험도 높은 짝의 비율을 계산한 것임(T. Therneau and Atkinson 2023). 수식은 위와 같음.

concordance(coxph.churn)Call:

concordance.coxph(object = coxph.churn)

n= 3866

Concordance= 0.8532 se= 0.004359

concordant discordant tied.x tied.y tied.xy

2794193 480630 22 40501 4 Cox 비례 위험 모형의 predict는 아래와 같이 5가지의 type을 지원함(T. M. Therneau and Lumley 2015).

lp: the linear predictorrisk: the risk score exp(lp)terms: the terms of the linear predictorexpected: the expected number of events given the covariates and follow-up timesurvival: The survival probability for a subject is equal to exp(-expected)

모형의 활용

lp: the linear predictor

predict(coxph.churn, data[test, ][1:5, ], type = "lp", , reference="sample") 792 1483 5275 6401 3608

-0.5829918 3.8812743 -0.4181787 -1.4452981 1.1453120 X <- subset(model.matrix(churn ~ ., data[test, ])[,2:21], select=-tenure)

new.X <- X - rep(coxph.churn$means, each=nrow(X))

(new.X %*% coef(coxph.churn))[1:5, ] 792 1483 5275 6401 3608

-0.5829918 3.8812743 -0.4181787 -1.4452981 1.1453120 risk: the risk score exp(lp)

predict(coxph.churn, data[test, ][1:5, ], type = "risk", reference="sample") 792 1483 5275 6401 3608

0.5582258 48.4859620 0.6582446 0.2356758 3.1434221 exp((new.X %*% coef(coxph.churn))[1:5, ]) 792 1483 5275 6401 3608

0.5582258 48.4859620 0.6582446 0.2356758 3.1434221 terms: the terms of the linear predictor

predict(coxph.churn, data[test, ][1, ], type = "terms", reference="sample") gender senior.citizen partner dependent multiple.lines

792 -0.1400065 0 0.5632269 -0.04698411 0

internet.service online.security online.backup device.protection

792 0 0 0 0

tech.support streaming.TV streaming.movie contract paperless.bill

792 0.4944679 0.1386901 0 -1.452303 0

payment.method monthly.charge

792 -0.05676702 -0.08331659

attr(,"constant")

[1] 1.43656coef(coxph.churn) * new.X[1, ]expected: the expected number of events given the covariates and follow-up time

predict(coxph.churn, data[test, ][1:5, ], type = "expected", reference="sample")[1] 0.10601990 0.87958365 0.09528528 0.08211137 0.05702481survival: The survival probability for a subject is equal to exp(-expected)

predict(coxph.churn, data[test, ][1:5, ], type = "survival")[1] 0.8994067 0.4149556 0.9091135 0.9211694 0.9445706exp(-predict(coxph.churn, data[test, ][1:5, ], type = "expected", reference="sample"))[1] 0.8994067 0.4149556 0.9091135 0.9211694 0.9445706상대적 위험도의 값에 따라 고객을 10개의 그룹으로 분류한 후, 그룹 내에서 이탈 고객의 비중을 구하여 모델을 검증할 수 있음(Li 1995).

train 데이터셋의 결과

predicted.risk <- predict(coxph.churn, data[train, ],

type = "risk")

groups <- cut(predicted.risk, breaks = 10)

tibble(groups,

predicted.risk,

churn=data[train, "churn"]) %>%

group_by(groups) %>%

count(churn) %>%

pivot_wider(names_from=churn, values_from=n) %>%

mutate(churn.ratio=round(yes/(yes+no)*100,1))# A tibble: 10 × 4

# Groups: groups [10]

groups yes no churn.ratio

<fct> <int> <int> <dbl>

1 (-0.0469,9.06] 288 1669 14.7

2 (9.06,18.1] 236 363 39.4

3 (18.1,27.1] 232 223 51

4 (27.1,36.1] 144 137 51.2

5 (36.1,45.1] 152 92 62.3

6 (45.1,54.1] 77 49 61.1

7 (54.1,63.2] 44 26 62.9

8 (63.2,72.2] 48 23 67.6

9 (72.2,81.2] 26 9 74.3

10 (81.2,90.3] 20 8 71.4test 데이터셋의 결과

predicted.risk <- predict(coxph.churn, data[test, ], type = "risk")

groups <- cut(predicted.risk, breaks = 10)

tibble(groups, predicted.risk, churn=data[test, "churn"]) %>%

group_by(groups) %>%

count(churn) %>%

pivot_wider(names_from=churn, values_from=n) %>%

mutate(churn.ratio=round(yes/(yes+no)*100,1))# A tibble: 10 × 4

# Groups: groups [10]

groups yes no churn.ratio

<fct> <int> <int> <dbl>

1 (-0.0403,8.32] 65 428 13.2

2 (8.32,16.6] 64 74 46.4

3 (16.6,24.9] 54 62 46.6

4 (24.9,33.2] 36 33 52.2

5 (33.2,41.4] 39 17 69.6

6 (41.4,49.7] 24 16 60

7 (49.7,58] 10 6 62.5

8 (58,66.3] 6 3 66.7

9 (66.3,74.6] 13 8 61.9

10 (74.6,82.9] 8 NA NA